When it comes to your debt, you should never dig a hole so deep, that you can’t get out of it!

According to CNBC the average American has $90,460.00 of debt. Now that is a lot of stress the average person has..

In my opinion, if you have that kind of debt, the only time you should see the inside of a restaurant is if you’re working there…

The fact is, more than half of Americans actually spend MORE than they earn each month, according to a Pew Research study, and use credit to bridge the gap. So it’s easy to see how so many people are struggling with debt and why most just choose to bury their heads in the sand. For many people in debt, the reality of owing so much money is too much to face, so they simply choose not to, and keep digging a deeper and deeper hole.

I learned many years ago how stressful and crushing debt could be, you can read my personal story here and see how I too once had over $60,000.00 in credit card debt alone..

No matter how much your debt is, or how crushing it feels, it is really not as tough to get out of it, as one might think…

All it takes is a plan of action and making some temporary sacrifices and one can actually get out of debt pretty fast. I am speaking from personal experience as years ago I paid off my own $60,000.00 in credit card debt, plus a lot more, and did it in only 8 months and got completely debt free.

Now I pay cash for almost everything I buy, I only use short term loans when I do not want to go below a certain threshold in my savings. Always having more than enough in savings to at any time pay off the loan.

What I have found over time, is the more money I have the less material goods even interest me, it is more about time with the people I love and doing things with them that is the importance. And not having looming debt hanging over your head changes the way you perceive things in life drastically.

Get Out Of Debt Fast Plan.

This plan is how I got myself out of debt, and keeps me out of debt.

First you will need to become accountable and committed.

1. You will need to make a decision to get rid of your debt once and for all and stick to it.

Use self talk to keep you committed. Talk to your self daily, so you have a laser focus that you are going to get rid of your debt. Change is the hardest part.

2. You will need to make some sacrifices temporarily, if you do not, nothing will change.

If your unwilling to make some short term sacrifices, do not even bother, you will be in debt the rest of your life. You have to be willing to say, no I do not need that.

3. Quit caring what your friends and family think “Stop keeping up with the Joneses” they do not pay your bills.

Do not buy a new car, just because your neighbor or brother did, many people do this and it is just plain STUPID!

Get Out Of Debt Fast Plan Steps.

Step 1. Write down your expenses and debt.

Write down all of your bills and include everything you spend money on in a month.

I am talking everything, be truthful with your self, you need to realize how much you are spending on unnecessary junk. By doing this you will start to identify where you are wasting your money.

Total this amount up, so you know on average what you are spending in total every month.

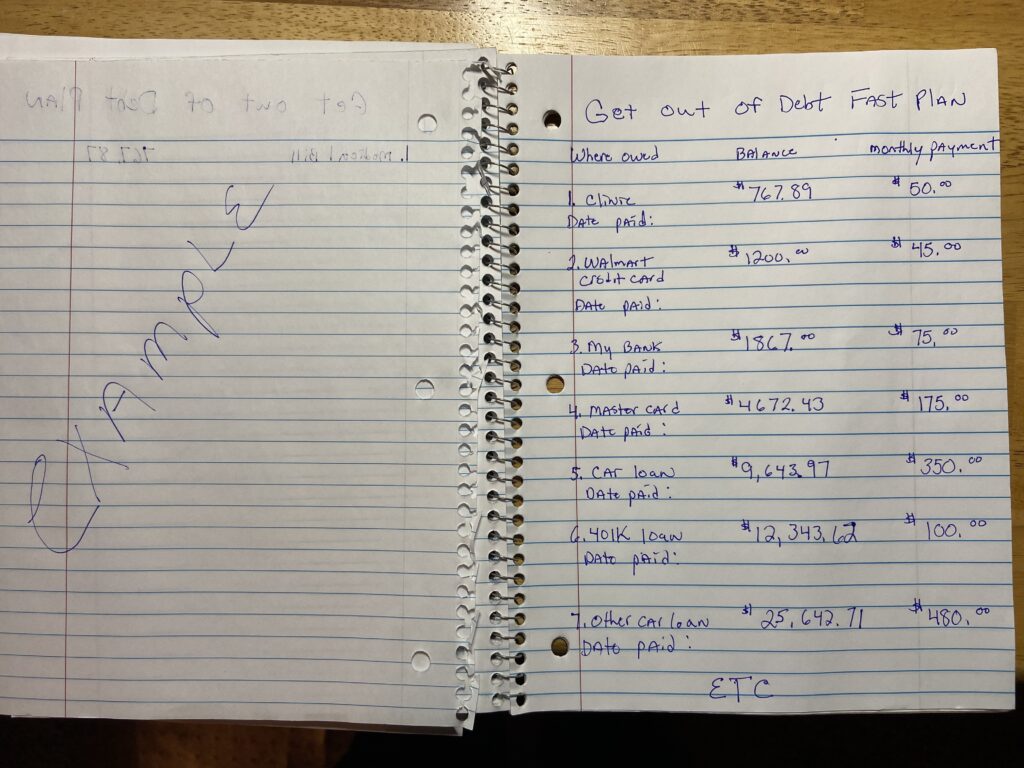

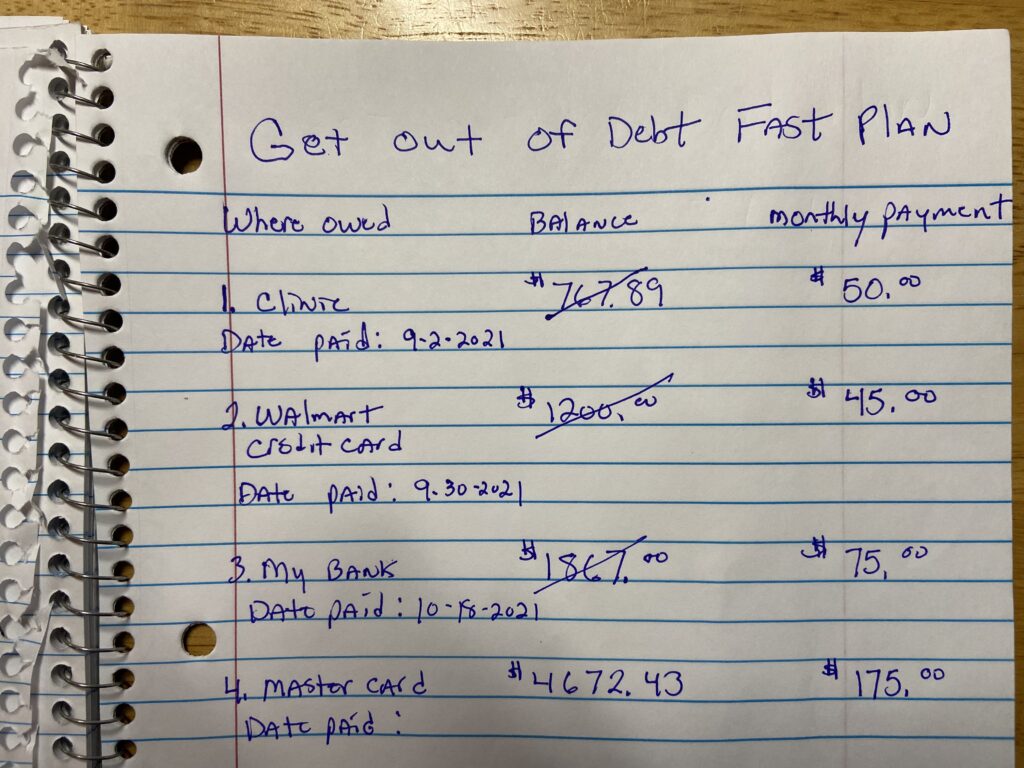

Next, write down in a notebook the amounts you owe on every loan, credit card, mortgage, car payment, medical bills, etc. List them in order of least amount owed to highest amount owed.

Also write down the minimum payment for each debt. Leave spaces between your entries for you to be able to write some future notes.

If you are unwilling to write down all of your expenses and debt, again don’t bother. There is something very magical in the brain that happens when you take pen to paper. Do not type it out on a computer, write it all down in a notebook!

Step 2. Reduce your spending immediately.

Create a household budget (give every dollar a job); cut all non-essential expenses.

Meal plan, do not eat out, eat left overs for lunch, do not purchase anything out of gas stations they are more expensive, you only get gas from gas stations from here on out. Do not go out to eat, you can not afford to.

Use coupons when shopping for food, buy when there are sales. Make inexpensive meals that last, beans, rice, potatoes, and ground beef make great hot dishes. If you drink pop, stop it, drink water, tea or coffee instead, they are less expensive and better for you anyways.

Stop buying clothes you have more than what you know what to do with. Stop buying lottery tickets, it adds up.

Reduce your TV bill. Cable and satellite TV programming is expensive. You can get a Roku player for like $30 and get tons of free movies and programming through the apps on it.

Better yet, sell all of your TVS and cut out watching TV all together until you are out of debt, this is what I did.

You will find that later on when you get TV again, your not as interested in it, and you will have become more active.

You will be amazed at how fast all of these things add up. Every dollar paid on debt, is all the faster you get rid of it.

Here is an example – Several years ago, I gave counsel to a couple that are good friends of mine, I once worked with the husband. The husband was always coming to work asking to borrow money from co-workers, people started getting pretty agitated by this, so I asked him what was the problem he was having.

He confided in me that they were always coming up short and were running out of money long before each payday. Now I knew how much money he made, as I was his boss, so I was surprised as to how this was happening, as many people where I worked made a pretty decent living and where we live the cost of living is very low.

So I figured like a lot of people, they were just spending more than they made, so I offered to help them by looking at their financial situation and find where they were going wrong.

One night they came over to my house and brought over a list of all their debts and expenses.

After looking at this list, I kept thinking okay, there must be something missing, as it looked like they had over $1600.00 leftover after paying all of their bills and monthly expenses.

I started asking them a few more questions, and started to pull out some additional information about what they were actually spending the rest of their money on.

Come to find out, the husband and wife were both buying several 20 oz bottles of pop a day, between the two of them it averaged 6 bottles a day.

At the time a bottle of pop was 1.89. So 6 bottles times 1.89 = $11.34 a day, times 30 days in a month = $340.20

Okay now were are starting to find out the truth, but wait there was more..

I next asked them how often they really ate out, and the wife admitted that they actually ate out for almost every meal. So between fast food, and dining in restaurants, we came up with an expense daily for them and their two kids of $60.00 a day on average. $60.00 a day times 30 days = $1800.00 a month.

Now if you take $1800.00 plus $340.20 that equals a whopping $2140.20 a month they were spending just on pop and eating out…Okay, pretty easy to see how every month they were going deeper in debt and coming up short..This may be eye opening to many who read this that do not realize how much stuff just adds up.

They were actually stunned, they never thought that their bad pop habit and eating out, would add up to so much money. As most people do, they way underestimated their actual spending habits, this is why you keep track and write it all down.

I am sure you can see by just this one example, how a couple like my friends, could easily make some changes and get out of debt extremely fast. Unfortunately for this couple they failed to make the changes and years later are still always struggling and borrowing money to make ends meet.

They will be drowning in debt forever.

There is a saying “Eat like a pauper for a little while, so you can eat like a king the rest of your life”

Step 3. Sell everything you don’t need.

Clear the clutter, we all have stuff lying around the house that we have never used or do not even need. Why not sell your extra stuff that you can live with out and use the funds to pay down your debts?

If you live in a neighborhood that permits it, a good old-fashioned garage sale is normally one of the fastest and easiest ways to unload your unwanted belongings for a profit.

Otherwise, in today’s internet era, pretty much every town has its own buy and sell pages on Facebook. My sister in law sells all her unwanted stuff this way, and says she gets more money for her stuff, and normally everything sells pretty fast.

Every little bit of money helps, and gets the process started, plus clearing some clutter out of ones life, can be a strong reinforcement of a new you. It can also give you a feeling of accomplishment towards your debt reduction goals.

My wife had a little problem for a while of not getting rid of stuff around our home, and kept adding more. Our basement was becoming over stacked with stuff. She started getting really overwhelmed and stressed out.

Then she stumbled upon a book called “How Not To Be A Messie.” That book really motivated her to (clear the clutter), and it got her excited about being even more organized in other areas of life. She actually started setting goals to get rid of so many items in a day. We had plenty of stuff that needed to go, and it did..

That book has impacted her ever since, and it makes her all giggly and smiley every time she references it. I am not going to lie its pretty cute.. 🙂

Step 4. Create more income.

Think about getting a part-time second job, working over time if available, or starting a side hustle online. It does not have to be a ton of hours so you burn your self out, just a little extra that can help to get rid of your debt faster.

Back when I got my family out of debt, I worked three jobs, one was full-time, and the other two were part-time. I wanted out of debt fast, and it only took me about 8 months to get us completely debt free. All of the steps I am listing in this article, I did everyone one of them to get my family out of hock, that is how I did it so fast.

Because of the current economy created by the pandemic and other events that have taken place over the last 2 years, there is a lack of employees to be had, and plenty of job opportunities and side hustles to go around, both online and offline.

You may even find yourself a much higher paying job in the process. Seems like every time I go into a business right now, they have a sign up and are looking to hire people.

Leave no stone unturned and use your talents to your advantage.

Step 5. Start with the smallest debt balances first.

Here is where the rubber meets the road so to speak, it is time to start paying off your debt, one at a time, and create a snowball effect.

This “snowball effect” allows you to pay off smaller balances first and get you a few “fast wins” for the psychological effect, while letting you save the largest loans for last when you have the most money to pay on them. Ultimately, the goal is snowballing all of your extra dollars toward your larger debts until they are crushed and you are all the way debt-free.

It will be at first as if your rolling a snowball uphill, and it keeps getting bigger and harder to push, but once you get to the top, it just takes a gentle push to get it to roll all of the way to the bottom. All the major effort is in the beginning.

Here is how it works…

You start with the smallest balances owed what ever that is, you will have them wrote down in a notebook, listed in order from smallest balance to largest.

Take all of the extra income you have uncovered from the previous steps, and pay off the smallest balances first, and only pay the minimums on all of the rest of your balances.

In your notebook cross off each debt as you pay them off and write down the date that you did in the space you left for notes. This will reinforce in your brain what you are working to accomplish and will aide you in not giving up on reaching your ultimate goal of being debt free.

Each time you pay off a debt in full, you will have more money to pay on the next one and so forth. You may even have several smaller ones you are able to pay off all at once.

This is by far the fastest way to get rid of all of your debt. It will create a momentum for you, as well as excite you because you are working your way to your goal and seeing real progress.

Never start with the largest balance, this is much slower, and will hinder your progress, as it takes longer to see the results you are wanting and may not free up as much money as fast. Because usually the bigger the debt owed, means a longer time you have taken the loan out for, which also means the smaller the minimum monthly payment is in relation to the balance..

6. Negotiate with your creditors.

If your situation is really dire and you have a bunch of debt that you have fallen behind paying on and it has been a while since you paid them anything, reach out to them and offer them a lesser amount to pay them off in one lump sum.

Creditors a lot of time will take a lesser amount, especially if it has been a long time since you have paid them anything, most of the time they will negotiate with you for a lump sum pay off that is less than your balance owed.

Even if it is a collection company who now owns the debt, they almost always are open to negotiating a lesser lump sum pay off.

So when you get to a specific creditor in your list you wrote down, that you have not been paying at all, now is the time to reach out to them and strike a deal. Typically, a creditor will agree to accept 40% to 60% of the debt you owe, although it could be as much as 80%, depending on whether you’re dealing with a debt collector or the original creditor.

Explain your situation to them, and that you are working to pay off all of your debt, and that you would like to pay them off today, but you only have __% of the balance and that is all you can afford to give them. They may come back with a counter offer.

Once you have an agreement, fulfill your end of the deal and pay them, but ask for something in writing stating that they have accepted a lesser amount and the debt is now considered paid off.

Some types of institutions you have debt with will not be open to negotiating, don’t be discouraged and continue on working towards your goal of being debt free. This is just an option for those that are truly in WAY over their head and have not been paying on their debts.

Step 7. Build your bank account & invest.

After you have paid off all of your debt, start building your bank account and investing your money into assets that will pay you. Start building your wealth. The same way you eliminated your debt, one step at a time, you can build real wealth for you and your family.

If you have never read the book by Robert Kiyosaki “Rich Dad Poor Dad” please buy it and read it. This book is a very easy read and very eye opening, it is one of my favorites on building passive income.

I never really got my head on straight until I was in my thirties, that is when I really committed to being debt free and building wealth. I did not want my sons to make the same financial mistakes as I did.

So I tried to teach my own sons about money and how to make it work for them, I wanted to give them a real example of what a measly $20 invested every month could do over time. I wanted to encourage them to start building wealth at a young age.

Over 13 years ago now, I bought 5 shares of my local power company stock and then eventually enrolled in their DRIP (Dividend reinvestment plan), it means my dividends are automatically reinvested back into more stock for me.

$20 is all I invest into this plan each month. I did this intentionally with only $20 to teach my sons the power of money working for them over time.

I have this $20 come out of my checking account every month as a recurring investment, so in 13 years I have invested personally only $3120.00. If I was to sell that stock today, its value has grown to over $12,000.00. So my money worked for me and made me passively almost $9000.00. And its picking up pace, because the dividends keep getting larger and larger, same as paying of debt it is the “snowball effect.”

Now over the years I have done this with several other stocks that I invested a lot more in, and they have grown even faster. More recently I have added many Cryptocurrencies to my investments.

The reason I used only $20 monthly and never increased it in this one stock, is because most young people in their late teens and early twenties are not thinking about investing their money and thinking long term.

I thought if I showed my sons a real example of such a small amount of money invested, and the power of how it grows, it just might encourage them to start younger, because it is not a large amount of money to let go of every month.

I wanted them to imagine if they just invested $20 monthly, how much money that one investment could be 30 years from now.

I got the idea from a little book by Deborah Rosen Barker & Julie Behr Zimmerman “Julie and Debbie’s Guide to Getting Rich on Just $10 a Week.” It is an older book, but if you want to learn how to do simple investing including DRIPS, I highly recommend it. The book is in layman’s terms, an absolute easy read.

Now the older you are when you get started investing, the more you need to stock away each month, so you get the exponential growth factor a lot faster.

I love watching my bank account grow and my investments, so every month most of my income is portioned out to doing so. When you manage your finances properly, and build assets that pay you passive income, your life will truly be what you have always wanted it to be, because “money” will no longer be an issue.

Imagine being able to take all the money you were using to pay off your debt, to now building your wealth, think how fast it could happen, it does not have to take decades…

Step 8. Don’t repeat your past mistakes.

After all of your hard work in finally getting debt free, do not repeat your past mistakes. Do not start digging another hole.

As it is easy to do because we now live an instant society, everything is instant, advancements in technology have made it so. I mean we carry around a phone, well basically a computer, phone, TV, music player, calculator, news media, etc, in our pocket. You can basically now get everything delivered to you, we no longer have to exert much energy for anything.

So people no longer understand delayed gratification and what it teaches us. Most people want everything right now, and they do not think in the long term. The generations growing up now are in for some real troubles financially, because delayed gratification means pain to them.

So always reinforce the positive changes you have made in your life. Build long term successful habits. Keep in practice “Delayed gratification.”

I have learned to always keep my self “mentally broke” meaning I say to my self I do not have the money for something, or I do not need what my brain is wanting me to impulse buy, even when I could buy it ten times over.

Always save and invest more than you spend on stuff. Think about purchases in relation to “Will that purchase eventually bring more money into my life, or only take money out of my life?”

Your self talk is very powerful, so control it, so it does not control you.

In conclusion:

Look at everything in your life as an opportunity to make things better, including your debt. Learn from it, and create a better life for you and your family.

I have seen people pay off over a hundred thousand dollars of debt in less than a year using these steps I have out lined for you.

Many people believe now a days, that debt is suppose to be lifelong thing, and that they won’t pay off their mortgage until they are old and gray, that does not have to be you.

I can introduce you to a couple that are friends of mine, that have have already bought and paid off 3 homes and then sold them all for huge profits, and they did it all before they turned 45 years old. And they did it on incomes of $15.00 an hour each.

It is all in how you spend the money you do have, remember if you keep digging a hole, it may get so deep, that you can’t get out of it. The get out of debt fast plan will work for you, if you do the work. How long it will take you, is up to you, and how much effort you put into following it.

The sooner you get started the faster you will get out of debt my friend.

If you have any questions or comments, don’t hesitate to post them in the comments section below or just say hello 🙂 I would love to hear from you!

Have a beautiful day, and remember to always be kind and good to others.

Sincerely,

Richard Weberg